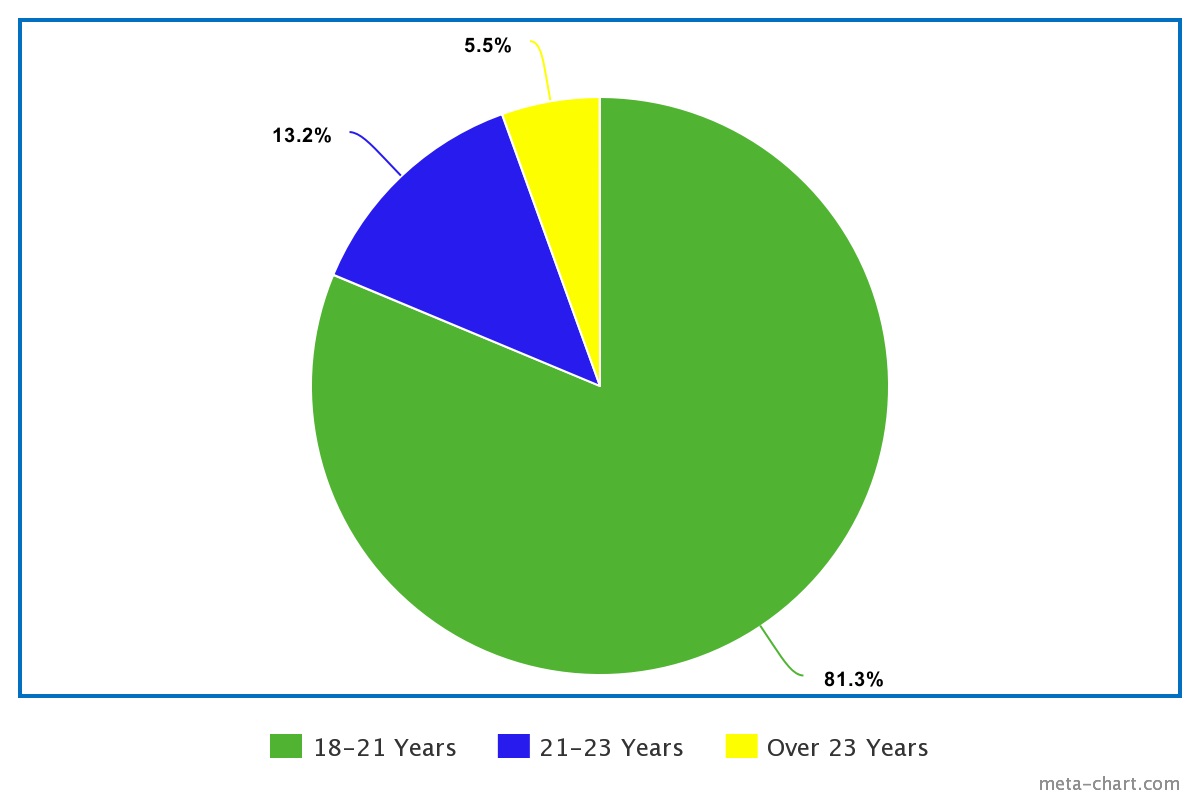

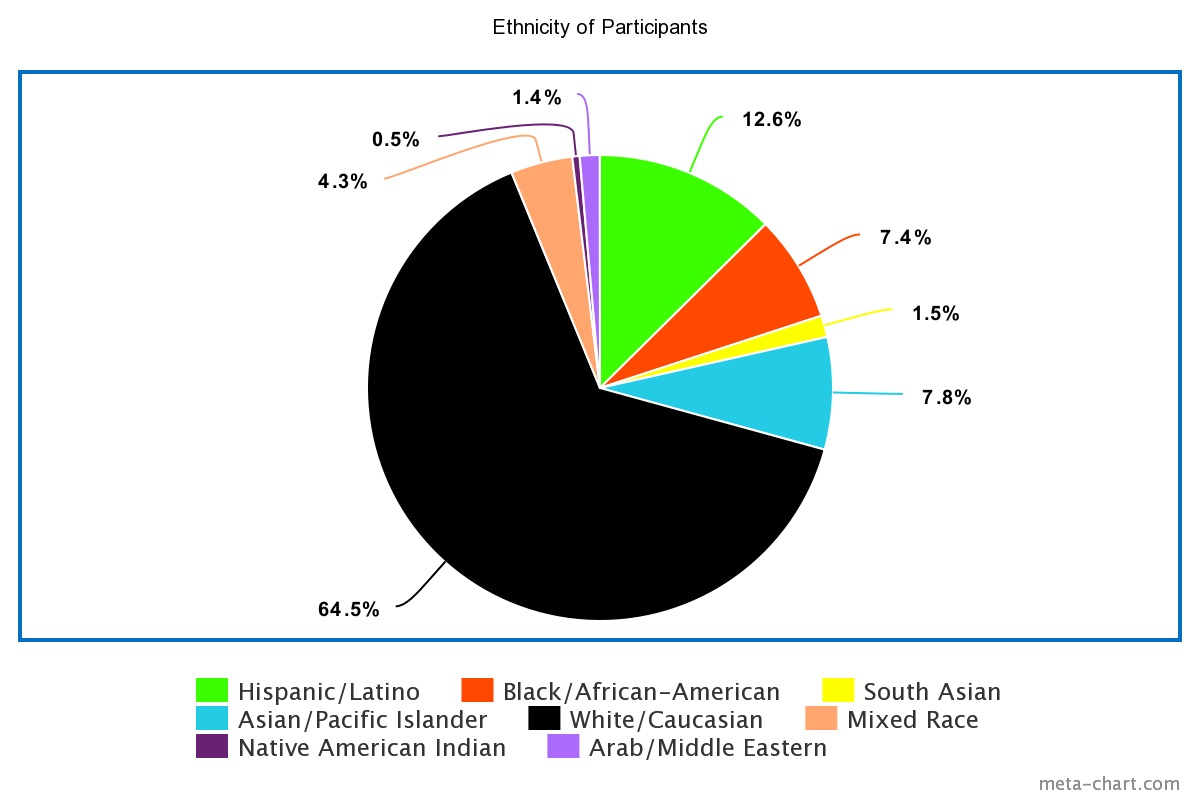

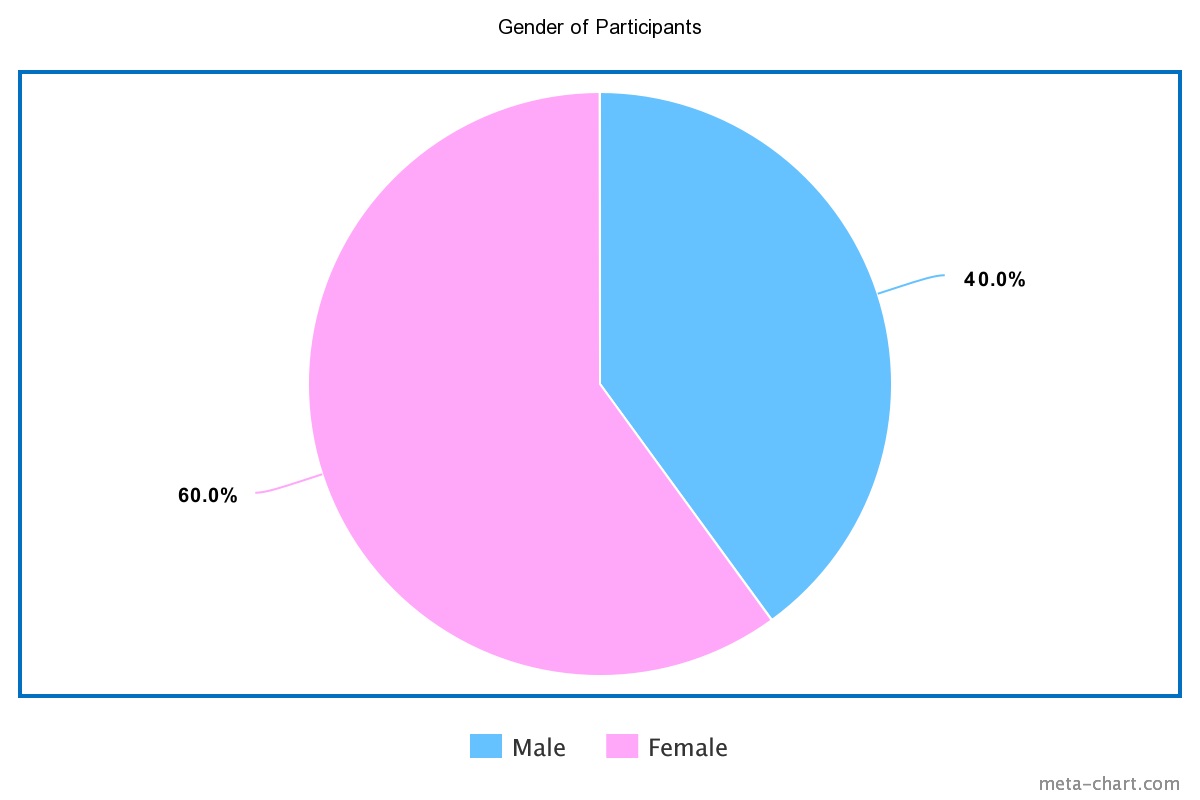

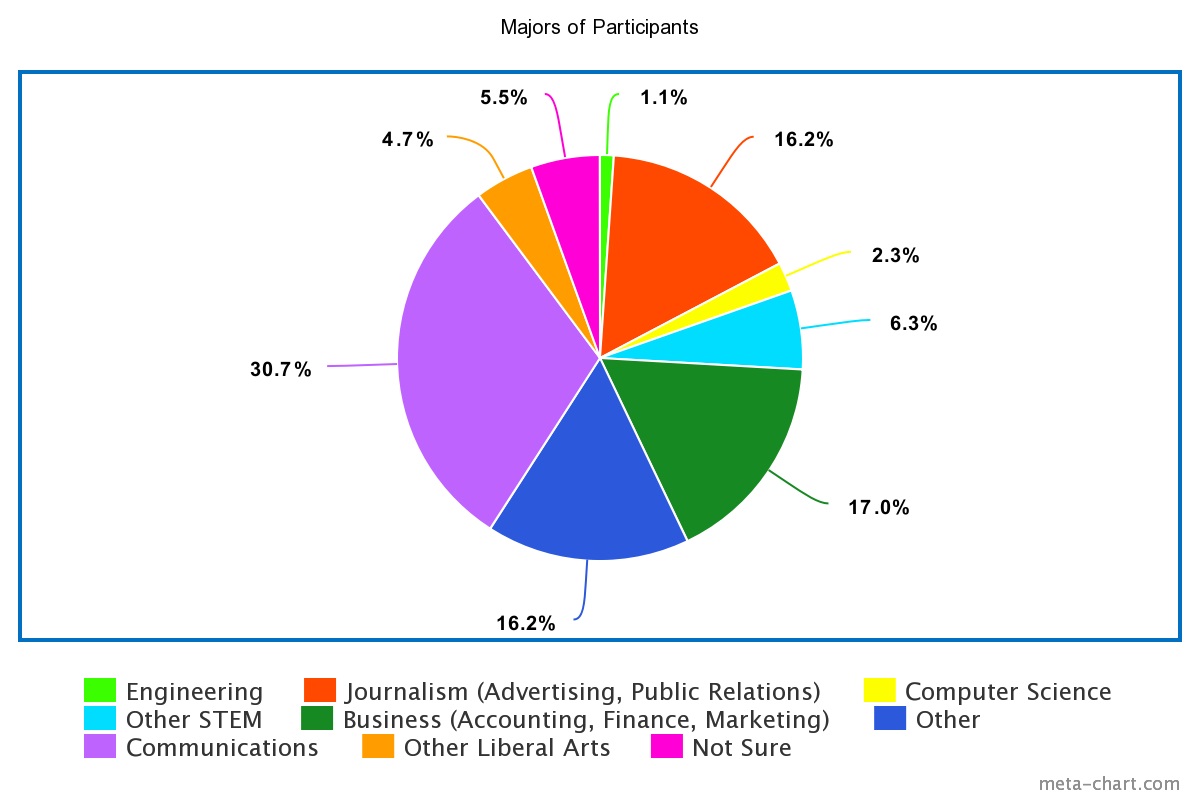

DigitalMediaIX has recently conducted a survey with college students across the United States in order to determine their brand preferences [See Appendix for Demographics]. We asked the students what types of cards (credit and debit) they owned and used on a regular basis. Below are the results. Note that these results were almost split exactly 50-50 between males and females, meaning there wasn’t a meaningful difference in card preference between men and women.

Visa Is a Student’s Best Friend

Out of all the survey participants, a whopping 74% owned a Visa debit card, making it the most popular option. In addition to this, the second most popular option was still Visa! 32% of these students owned a Visa credit card. With these top two results, Visa absolutely blew past all other card companies in the race to students’ wallets.

MasterCard Is Lagging Behind

The third most popular card option for students was the MasterCard debit card. However, only 22% of students claimed to own this option, less than a third of the Visa debit card. Nonetheless, it should not be simply dismissed.

Additionally, we asked students, “If you own more than one credit card, which one do you use most often?” The Visa debit card was once again in first place here, at 64%, however, MasterCard was now in second place at 15%, ahead of the Visa credit card. This was interesting as it showcased most students would use a debit card over a credit card regardless of the issuing company.

Why is this?

First, we looked at acceptance. Perhaps the most important aspect while opening a card is acceptance, as in, “Will I be able to use this card while traveling and at my favorite restaurants?” Both Visa and MasterCard are widely accepted around the world, so there really wasn’t a winner in this category.

Next, we looked at cardholder benefits. This is where Visa began to crawl ahead. Though your benefits will differ within the tiers of cards you get with these companies, let’s assume in this case that the students just went with the standard or traditional plan. For MasterCard, this would mean zero liability protection, price protection, emergency card replacement and emergency cash dispersal and aid with lost or stolen card reporting. For Visa, this would mean the cardholder receives roadside dispatch, zero liability protection, auto rental collision damage waiver, emergency card replacement and emergency cash dispersal and aid with lost or stolen card reporting. As you can see, Visa has just slightly more benefits, which might be what is causing it to be the more desirable option.

What about the other options?

Maybe the battle isn’t between Visa and MasterCard after all. Perhaps Visa and MasterCard are the winners, and other card companies such as American Express (9%) or Discover (8%) are the ones lagging behind. This gap is often times because companies such as American Express and Discover issue credit cards and operate payment networks by themselves, whereas Visa and MasterCard do not issue their own credit cards. In addition, American Express and Discover cards are not as widely accepted as Visa and MasterCards.

Why should you care?

Obvious as it may be, you need to let your products and services be as accessible as possible to your customers. In other words, make sure you accept cards that most people use at your businesses, especially Visa and MasterCard so they are able to purchase what they want, when they want it.

Appendix:

Sources:

https://www.mastercard.us/en-us.html

https://www.creditkarma.com/credit-cards/i/visa-vs-mastercard/

https://www.canstar.com.au/credit-cards/visa-or-mastercard/